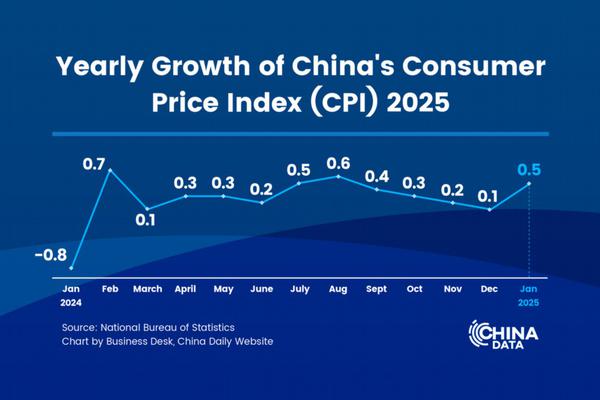

China's economy is showing fresh signs of recovery as consumer inflation accelerated in January due to the influence of the Spring Festival holiday, official data showed on Sunday, pointing to a gradual recovery in domestic demand. Analysts said that China's economy will likely make a robust start in the first quarter, given the country's intensified efforts to expand the consumer trade-in program for 2025, the accelerated push for implementing key projects and the early signs of stabilization of the property market. They, however, cautioned that the broader economy is still facing challenges from subdued demand and external uncertainties, urging policymakers to step up countercyclical adjustments in fiscal and monetary policies, including a comprehensive stimulus package to spur consumer spending and stabilize the housing sector. Data from the National Bureau of Statistics showed on Sunday that the country's consumer price index, a main gauge of inflation, rose 0.5 percent year-on-year in January after a 0.1 percent growth in December. The growth in core CPI, which excludes volatile food and energy prices and is deemed a better gauge of the supply-demand relationship in the economy, rose 0.6 percent year-on-year in January, after a 0.4 percent increase in December. Feng Lin, executive director of research at Golden Credit Rating International, said that consumer prices rose at a faster pace in January mainly due to the timing difference of the Spring Festival holiday, which started in January this year compared with February last year, and thus led to faster growth in food and service prices. "Looking forward, consumer inflation will likely remain within a low level in 2025, leaving ample space for stronger countercyclical policy adjustment," she said.  Shoppers seen at a supermarket in Zaozhuang, Shandong province. (SUN ZHONGZHE/FOR CHINA DAILY) Feng noted that the subdued consumer demand remains a major challenge, primarily due to the ongoing correction in the real estate market that dampens consumer sentiment, along with a slowdown in per capita disposable income growth last year, which has affected household purchasing power. "That provides plenty of room for policymakers to intensify efforts to further boost consumption," she added. NBS data showed China's producer price index, which gauges factory-gate prices, dropped 2.3 percent year-on-year in January, unchanged from the figure in the previous month. Feng said the recovery in market demand has yet to provide strong support for industrial products price growth, noting that the "timing of the PPI inflation's return to positive territory will largely depend on the effectiveness of China's countercyclical policy measures in 2025, with real estate support policies playing a pivotal role". During a news conference at the beginning of 2025, the National Development and Reform Commission said the annual quota for the consumer goods trade-in program for the year, which will be significantly larger than that of 2024, will be announced during the two sessions, the annual meetings of China's top legislative and political advisory bodies. Louise Loo, lead economist at British think tank Oxford Economics, said: "In the upcoming two sessions in March, we expect meaningful increases in bond quotas earmarked for stimulus spending, with roughly a third going toward consumption-oriented support measures, including the recently expanded consumer goods trade-in program. The coming months will likely feature more consumption-oriented stimulus." On the fiscal front, as the fourth-quarter monetary policy meeting of the People's Bank of China, the country's central bank, signaled more cuts to the reserve requirement ratio and policy rates "at an appropriate time", Loo said her team expects a cumulative 40-basis-point cut in the main policy rate, which would be the largest single-year cut since 2015, and a 150-basis-point cut in the RRR in 2025. Luo Zhiheng, chief economist at Yuekai Securities, said that despite facing pressures from structural issues at home and uncertainties from the international environment, China still enjoys favorable conditions to foster steady growth in the first quarter, considering supportive government measures to boost consumer spending and corporate investment and early signs of stabilization in the property market. Li Chao, chief economist at Zheshang Securities, said China's economy will make a strong start in the first quarter. "China's annual growth target for 2025 could be set at around 5 percent, unchanged from the previous year. The GDP growth rate will likely hit 5.1 percent in the first quarter, with the full-year economy experiencing a U-shaped recovery," Li said. Deutsche Bank said in a new report that it is becoming "impossible to not acknowledge" China's superior performance in multiple spheres such as manufacturing and increasingly services, the report said. "We believe the bull market for H shares and A shares began in 2024 and will exceed prior highs in the medium term," the report added. |

Powered by Discuz! X3.4 Licensed

© 2001-2013 Comsenz Inc.